Determine rate of return on investment

The required rate of return RRR is the minimum amount an investor or company seeks or will receive when they embark on an investment or project. ROI NOI appreciation cost.

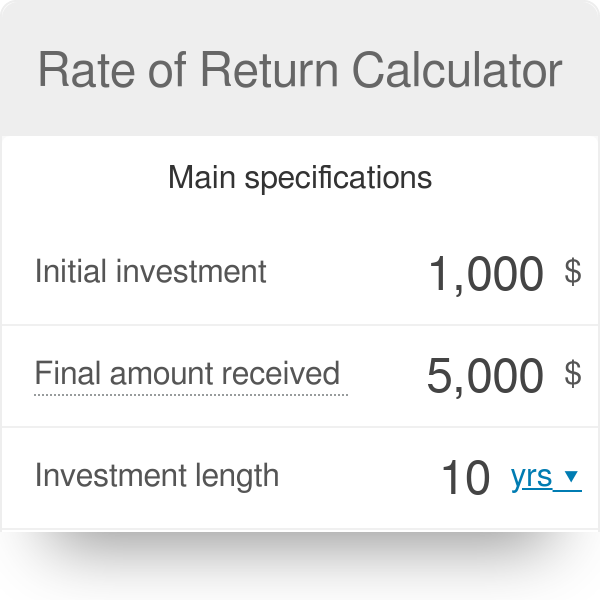

Rate Of Return Calculator

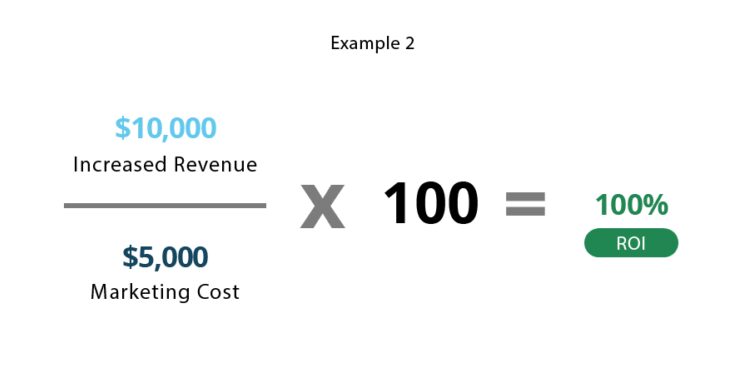

250 20 200 200 x 100 35.

. The Free Calculator Helps You Sort Through Various Factors To Determine Your Bottom Line. N Interest payment frequency. This is based on doing a calculation on the difference between prices in 2 periods of time.

To calculate the propertys ROI. Ad Meeting Your Long-Term Investment Goals Is Dependent on a Number of Factors. Nominal rate of return vs.

Enter current value of the investment in one row. When the time length is a year which is the typical case it refers to the. Ad Meeting Your Long-Term Investment Goals Is Dependent on a Number of Factors.

Then multiply the result by 100 to get a percent value. Probability of Gain A. Multiply the result by 100 to.

Follow these steps to calculate a stocks expected rate of return in Excel. As a most basic example Bob wants to calculate the ROI on his sheep farming. Three measures of return.

Gain A C1. Annualized Rate of Return. The formula for the inflation rate is T1-T0T0 x 100.

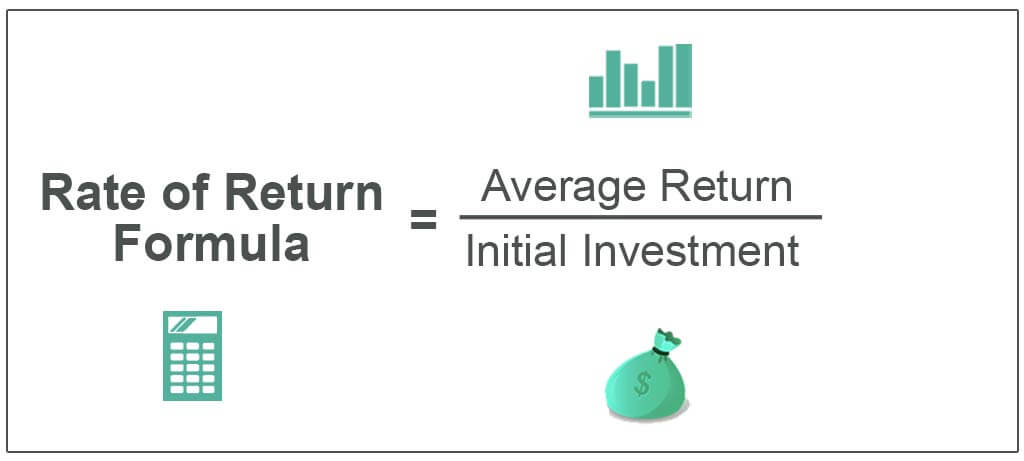

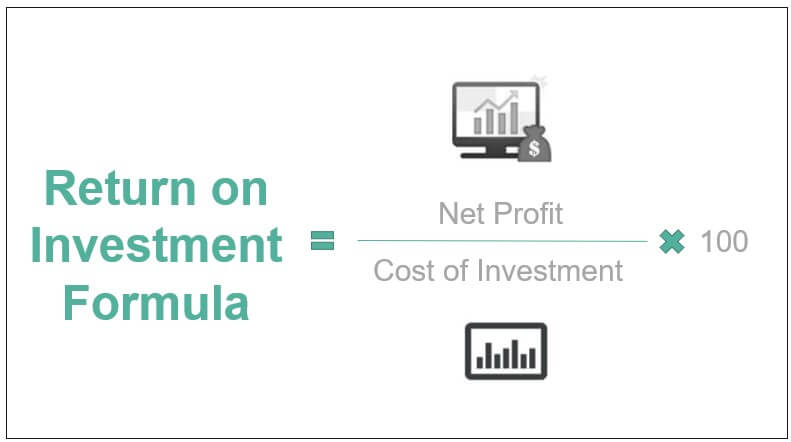

Enter original value cost of investment in row below current value. Plug all the numbers into the rate of return formula. ROI is the return calculated on basis of the difference between the initial investment and the current or final value of an investment divided by the initial investment.

Annualizing the ROI is recalculating the ROI percentage as an annual rate of return. To calculate rate of return in an Excel spreadsheet you can easily enter a formula. To calculate return on investment you should use the ROI formula.

The RRR can be used to determine an investment. If an initial investment generated a 40 return the nominal rate would also be 40. To calculate return on investment you should use the ROI formula.

These Top Brokerages Offer Tools For New Investors And Those With Years Of Experience. Rate of return on investment in property calculation as 200000 100000100000 100 100. In finance a return is a profit on an investment measured either in absolute terms or as a percentage of the amount invested.

There are three main methods of calculation which are frequently used. To calculate the required rate of return you must look at factors such as the return of the market as a whole the rate you could get if you took on no risk risk-free rate of return. Ad New And Experienced Investors Should Consider These Top-Recommended Brokerages.

Ad TD Ameritrade Investor Education Offers Immersive Curriculum Videos and More. If you finance your real estate purchase with all cash to calculate real estate return on investment add net operating income and appreciation of the real estates value and divide it by the initial purchase price. Therefore Adam realized a 35 return on his shares over the two-year period.

However inflation reduces the purchasing power of money. The rate of return formula is equal to current value minus original value divided by original value multiply by 100. Using the expected return formula above in this hypothetical example the expected rate of return is 71.

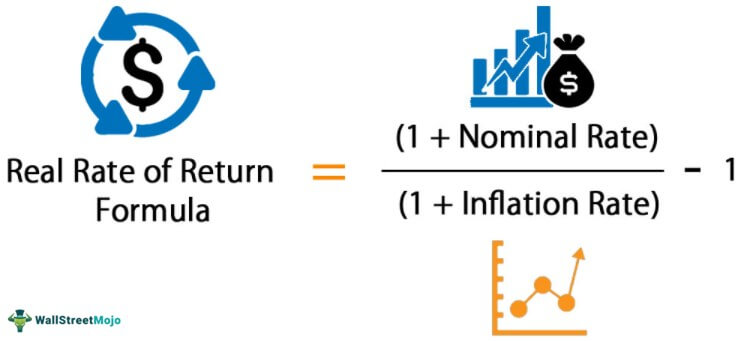

To calculate the annualized version of the ROI in other words the ROI projected to a yearly rate of return you can multiply the cumulative ROI by 12 and divide it by the holding period of the flip measured in months. 3- Finally The formula for real interest rate can be derived by dividing one plus the nominal interest rate step 1 by one plus the inflation rate step 2Formula for Inflation Rate. A bought a property in 2011 for 100000 and in the year 2019 the said property was sold for 200000.

Since the size and the length of investments can differ drastically it is useful to measure it in a percentage form and to compute for a standard length when comparing. A portfolios return on investment ROI can be calculated as follows. In the first row enter column labels.

In the Manufacturing business case Return on Investment Revenue Cost of goods sold divided by the cost of goods sold. Simple Rate of Return SRR Money Weighted Return MWR equivalent to the Internal Rate of Return IRR Time-Weighted Return TWR SRR is a. The Annualized Return on Investment Formula.

Current value - Original valueOriginal value. The formula for the real rate of return can be used to determine the effective return on an investment after adjusting for inflation. Note that the regular rate of return describes the gain or loss expressed in a percentage of an investment over an arbitrary time period.

How to Calculate ROI. In a row above these two enter the formula for rate of return. Current or ending value - Initial or starting value Dividends - Fees Initial Value.

They sound similar but the way they work and the conclusions they provide vary greatly. Calculate Expected Rate of Return on a Stock in Excel. The simple rate of return weve discussed so far is considered a nominal rate of return since it doesnt account for inflation over time.

Real rate of return. 250 20 200 200 x 100 35. It is a basic rate of return that can be derived for any investment which can mislead the investors.

Real Rate Of Return Definition Formula How To Calculate

Rate Of Return Definition Formula How To Calculate

Return On Investment Roi Formula Meaning Investinganswers

/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)

Inflation Adjusted Return Definition

Rate Of Return Formula What Is Rate Of Return Formula Examples

How To Calculate The Return On Investment Roi Of Real Estate Stocks Youtube

Return On Investment Roi Definition Equation How To Calculate It

Return On Investment Roi Formula And Calculator Excel Template

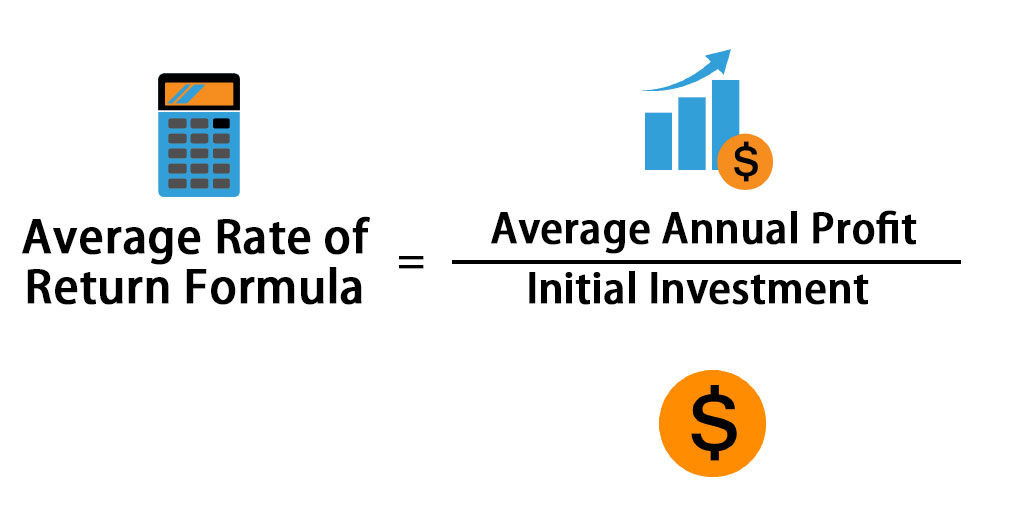

Average Rate Of Return Formula Calculator Excel Template

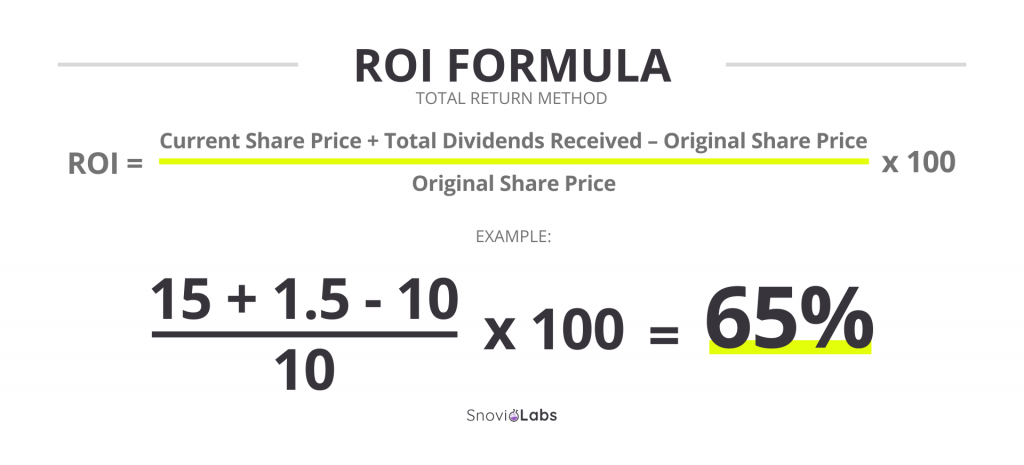

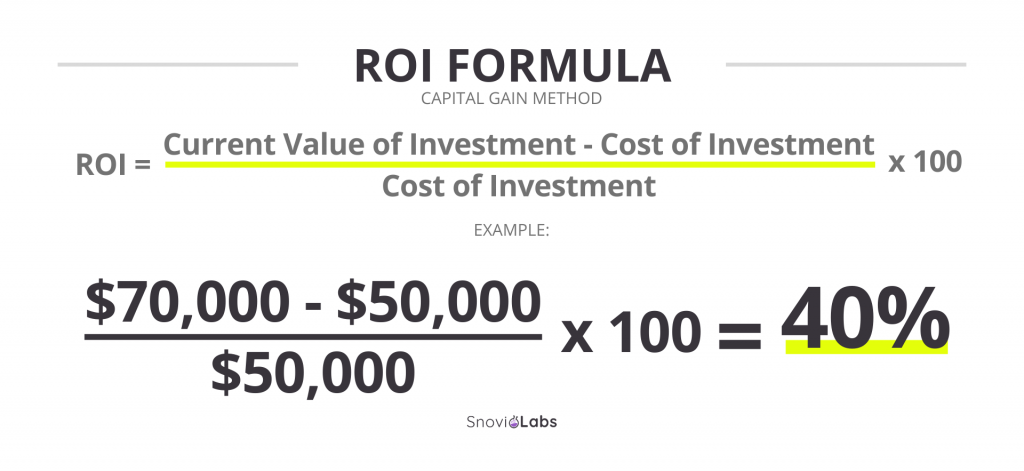

What Is Roi Definition Formulas And Tips Snov Io

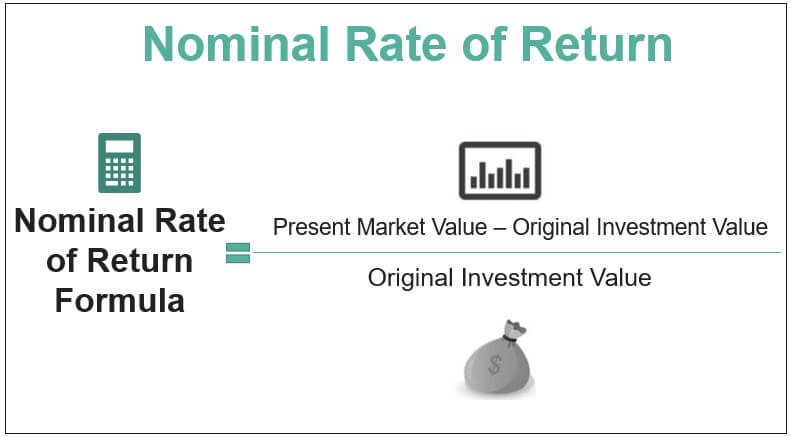

Nominal Rate Of Return Definition Formula Examples Calculations

What Is Roi Definition Formulas And Tips Snov Io

Rate Of Return Formula Calculator Excel Template

Return On Investment Definition Formula Roi Calculation

.jpg)

Return On Investment Roi Formula Meaning Investinganswers

Return On Investment Roi Definition Equation How To Calculate It

Calculating Return On Investment Roi In Excel